SOPHISTICATED WEALTH MANAGEMENT FOR FAMILIES

Curated Investment Strategies, Tax Optimisation & Legacy Planning With Melbourne’s Bespoke Wealth Management Advisors

Reserve Your No-Obligation Wealth Management & Planning Session With Our Principal Advisor

(Value $500)

A Private Message For Melbourne's Affluent Professionals & Business Owners

Dear Wealth Builders,

Is increasing tax pressure eroding the wealth you've worked decades to build?

Are you concerned about preserving your legacy across generations?

Nervous about market volatility and if you’re correctly positioned in the market?

What follows is not ordinary financial planning advice…

But a private invitation extended to Melbourne's select few who demand excellence in wealth management.

Your financial success represents years of diligence, strategic decision-making, and calculated risk.

It deserves to be protected and nurtured with the same level of sophistication that built it.

Yet, 67% of high-net-worth individuals report dissatisfaction with their current wealth management strategy . (Source: Capgemini World Wealth Report)

The difference lies not merely in investment selection.

But in the expert planning of integrated tax strategies, asset protection mechanisms, and succession planning that works together to protect everything you’ve done.

👋 Hi, I'm Cameron Smith, founder of Bensons Wealth.

For 35 years, our private wealth division has served Melbourne's most affluent individuals — business owners, executives, and accomplished professionals who require more than standard financial advice.

If you're seeking:

Sophisticated tax minimisation strategies beyond basic superannuation planning

Discreet portfolio restructuring for optimal asset protection

Legacy planning that ensures generational wealth transfer

Strategic diversification across multiple asset classes

Then I invite you to schedule a private, complimentary 'Wealth Preservation & Growth' consultation.

During this exclusive session with our senior advisor, you'll:

Uncover hidden inefficiencies in your current wealth structure

Discover bespoke protection strategies for your specific asset composition

Explore sophisticated tax planning opportunities often overlooked

Review your estate planning to ensure alignment with your legacy intentions

Proper wealth management should instill confidence, not uncertainty.

With a strategic wealth plan tailored to your unique situation, you'll gain clarity and control over your financial future.

To arrange your private consultation, select an available time using the scheduling tool below.

With discretion and excellence,

Cameron Smith

Founder & Principal Advisor

Bensons Wealth

3,000+ Australians Have Chosen Bensons Wealth To Guide Them To A Comfortable Retirement

Di

“We Wanted To Be Able To Live A Full Life”

Angel & John Faraguna

"When We Had The First Phone Call I Felt Quite Comfortable Speaking With Them”

Pam & Geoff Kohn

“I thought I'd have to work until I got my pension, but thanks to Bensons Wealth I can retire earlier if I want to. I feel really comfortable and confident about my future now.”

Debra

“They truly listened and provided practical advice. Working with him has been straightforward and trouble-free—exactly what we needed.”

Rob & Rose

"I Wanted A Worry Free Retirement... Which I've Got Now!”

Brian Davis

"They’ve made all the stress and worries go away, and I feel confident and secure, knowing my financial future is in good hands."

Leslie

"I no longer worry about my finances when I have a plan to sustain my lifestyle and I can seek their guidance whenever I need it."

Christine

Melbourne’s Premiere Retirement Planning Firm For Retirees Who Want More…

‘Knowledgeable, Open, Trustworthy’

Bensons Wealth has helped guide 3,000+ Aussies to retire comfortably and without compromise.

As a small family business, we offer you personalised service tailored to your unique needs and goals.

Our team, led by Cameron, provides expert advice to help you develop a solid strategy you can trust and rely upon for a comfortable retirement.

Registered with ASIC and the Financial Adviser Register (FAR). We ensure the highest standard of professionalism and care for our clients.

Everyday, we’re on the frontlines, guiding our clients to protect their money, lower their taxes and navigate changes in the ever-changing markets.

After supporting 3,000+ Aussies across Australia, we’re here to support you and guide you through all aspects of your retirement.

And it all starts with getting a plan in place.

To get started, take the free ‘Will I Have Enough’ Retirement Consultation by clicking the button below.

We Partner With The Very Best

And Many More....

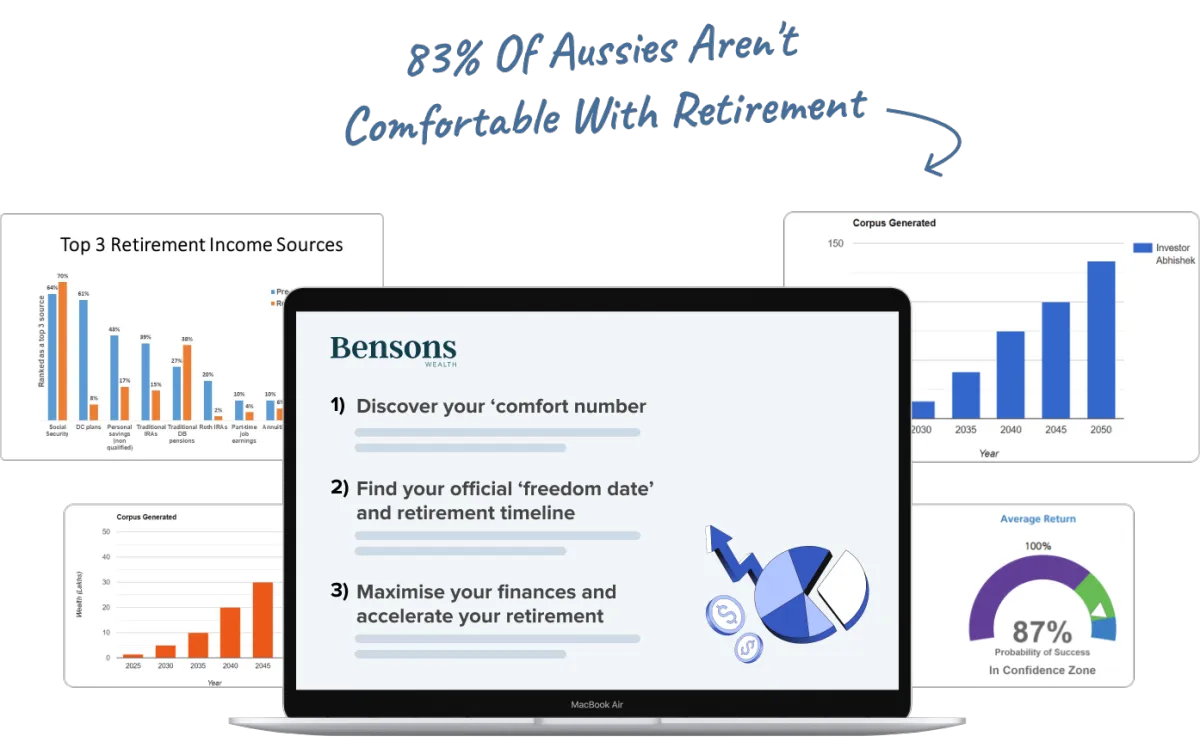

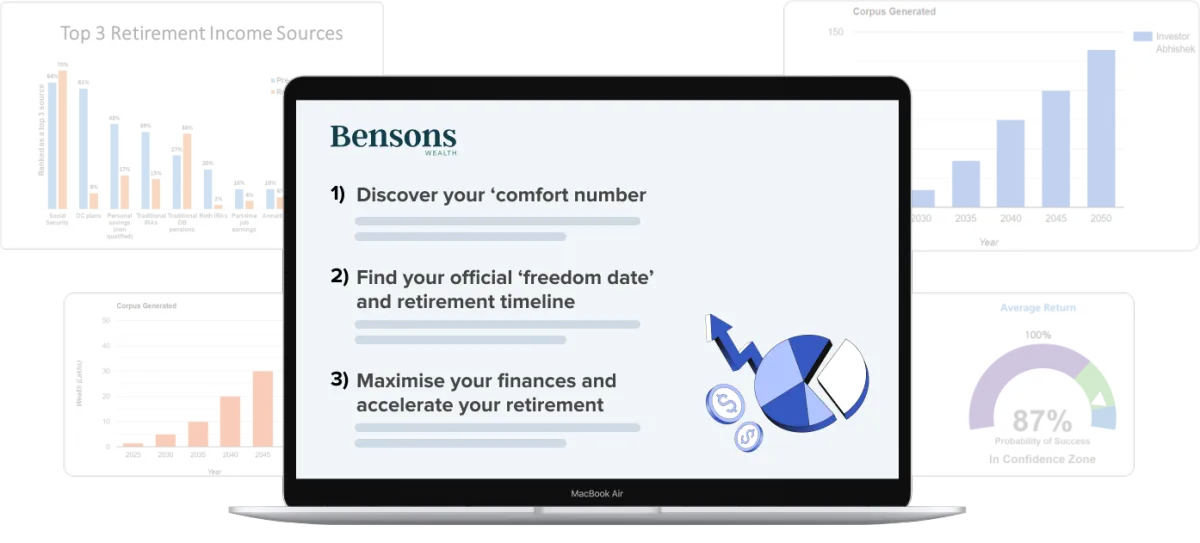

HOW IT WORKS:

Plan Your Legacy & Wealth In

3 Simple Steps:

STEP-1

Apply for Your Wealth Planning Consultation

Fill out our simple form and tell us more about your situation and plans.

STEP-2

Speak With Our Principal Advisor Cameron Smith

With 35+ years experience, working with Australia’s ultra-wealthy, Cameron can help assist you with a bespoke wealth management plan.

STEP-3

Get Expert Assistance On Your Situation & Future

Get crystal clear clarity on how to optimise taxes, diversification and legacy planning for you and your loved ones.

6 Reasons Why Our Clients Trust Us To Protect And Plan Out Their Retirement

Tailored to Your Ideal Lifestyle:

We craft retirement plans that revolve around your unique dreams and ideal lifestyle. We craft our plans around your goals, allowing you to enjoy your golden years to the fullest.

Unmatched Professionalism and Trustworthiness:

With over 35 years in the industry, your financial security and aspirations are our top priority. Our 3,000+ clients have chosen us and stay with us because of our impeccable track record.

Crystal Clear Communication:

Expect clear, prompt, and jargon-free updates that keep you fully informed. Our clients appreciate our straightforward and caring approach, ensuring there are no surprises with pro-active updates.

A Plan To Protect & Preserve Your Capital:

Our comprehensive strategies are designed to not only grow your retirement nest egg but also protect your capital from market volatility and inflation.

Expert Financial Knowledge:

Our seasoned advisors break down complex financial concepts into easy-to-understand language. This clarity empowers you to make informed decisions with confidence, knowing you’re guided by the best in the field.

No Lock-In Contracts:

Enjoy the flexibility of no lock-in contracts, knowing we are dedicated to providing you with tier 1 support and guidance at all times. We’re always working with our clients guiding them at every step of the retirement journey.

Helping Soon To Be Retirees To Get Setup For A Comfortable Retirement

"I’ve been dealing with Cameron for about ten years now and find him extremely helpful with all my financial planning for the present and well into the future. I am very pleased with his attention and professionalism!"

Chris Roberts

"I met with Eden at Bensons Wealth who looks after our Superannuation account. He is always very helpful and gives us good advice and some future projections depending on our strategy. I would have no hesitation in recommending Bensons Wealth to other family members and friends."

Gerard Luscombe

"My wife & I met with Chris for the first time this week. We had been seeing another advisor for some years so we were not sure what to expect and went to the meeting with some trepidation. We should not have worried, Chris was excellent..."

Ian Glascott

"My wife and I have had Chris looking after our financial matters for a few years. It is so important to have sound advice especially when approaching retirement."

Peter T

"I have been a client of Bensons Wealth for over 15 years. Throughout this time, they have consistently provided exceptional service and sound financial advice. I trust them completely with my investments and retirement planning."

John Smith

"Happy with their service, get great advice, options, they explain anything I don't understand and yes I would recommend this company, so far I do feel well looked after."

Monica Martinez

"As we headed towards retirement and having no plan, we approached Bensons for financial advice. Cameron and his team made us so feel so comfortable as we discussed our future goals..."

Angela Faraguna

"Chris has been great to liaise with. He listens and communicates very effectively. I feel confident with the management and ongoing support with which my circumstances and needs are handled. Highly recommended."

Leisel

"We always have a clear understanding of how our financial situation is. Chris is very professional and goes over and above to help me understand everything. We couldn’t be happier."

Wendy Davies

Bensons Wealth Can Help You With All Your Retirement Planning Needs:

Comprehensive financial planning

Debt management

Estate planning

Investment management

Tax optimisation

Ongoing financial monitoring and adjustments

Retirement planning and income strategies

Superannuation advice

Concierge service for administrative needs

WARNING!

Many Affluent Aussies Are At Risk Right Now With Market Volatility

In today's uncertain economic landscape, improperly positioned portfolios face unprecedented risk.

Many affluent investors remain dangerously exposed without realising it.

The wealth you've spent decades building can erode rapidly when positioned in vulnerable asset classes during market corrections.

For high-net-worth individuals, traditional diversification often proves inadequate against systemic market events.

Our wealth management clients have weathered recent volatility with strategic asset allocation designed specifically for capital preservation during turbulent periods.

Delaying this assessment leaves your hard-earned wealth unnecessarily exposed each passing day.

Schedule your private consultation today, get your portfolio reviewed, and make sure you’re not over exposed so you can secure the protection your wealth deserves.

Your legacy is too important to leave vulnerable to preventable market disruptions.

Frequently Asked Questions

What is the ‘Will I Have Enough?’ Retirement Consultation?

Our consultation helps determine your ‘comfort number’ and ‘freedom date’ for a comfortable retirement. Is the consultation really free? Yes, it’s completely free with no obligation to move forward.

How long does the consultation take?

This depends on when you book in your free consultation call - typically you’ll receive it within a week.

What if I don’t have a lot of savings?

Our analysis helps you make the most of what you have. We typically help clients with a savings/super amounts of $300K to $3M.

Can I trust Bensons Wealth?

With 35+ years, 3,000+ clients, and a stellar reputation, we guide you to a comfortable retirement.

The most important thing is that you feel comfortable and safe. This is why we have our ‘Will I Have Enough’ Retirement Analysis. It’s a way for you to see if we are a good fit, and that we can truly help you with your financial goals.

What are your fees?

Fees vary based on your needs and level of service required.

We don't take commissions or kickbacks—our focus is solely on working for you.

Plus, we offer an industry leading, no long-term contracts; ensuring that we always provide you with Tier 1 service.

Why Do I Need A Financial Planner?

Think of us as mechanics for your money. We help tune up your money and portfolio of investments. We look to grow and protect your money, ensuring your retirement dreams become reality and guide you through your financial decisions.

How does it work if we work together?

As an independent family business, we tailor your plans to fit your needs, not push products.

We partner with you so you can make informed decisions about your money throughout the year. We guide you to make smart decisions and help you to protect your wealth and grow your investments.

You’re in complete control, and we’re here to guide you to make the best decisions when it comes to your financial future.

How much do I need to retire?

It depends on your lifestyle goals and retirement location. We'll crunch numbers to see if your savings support your plans.

If adjustments are needed, we'll work on strategies to get you there comfortably and securely.

Do you only invest my money?

We look at your entire financial picture—debts, income, taxes, retirement goals, investments, insurance, super and tax.

Our goal is to grow your wealth, save on taxes, and protect from financial risks for a safe retirement journey.

Reserve Your No-Obligation

Wealth Management & Planning Session With Our Principal Advisor