IS $1 MILLION ENOUGH TO RETIRE IN AUSTRALIA IN 2025?

Discover How 3000+ Aussies Learned About The 'Will I Have Enough' Index To Assess How Much They Need For A Comfortable Retirement

Apply For Your Free Retirement Consultation Today And Speak With A Specialist To Create A Comfortable Retirement For You And Your Family (Value $500)

Is This Right For You?

You have $400K+ in super or other investable assets.

You’re open to professional guidance and want to explore what’s possible.

You need clarity on exactly when you can retire—and how much capital you’ll require.

You’re planning to retire in the next 1–10 years

If this sounds like you — you're in the right place.

An Urgent Message For Future Retirees Who Don’t Have A Plan In Place…

Dear Future Retiree,

Are you concerned if you have enough Super for retirement?

Or do you feel that inflation is eating away at your savings?

Looking for ways to increase savings and lower your tax?

The message you’re about to read is going to solve all that and more.

Your retirement is a milestone after years of hard work.

It should be a time to relax and enjoy life.

Yet, 83% of Australians aged 50+ worry that their savings won’t be enough for retirement. (Source: Finder)

But with the right plan, smart strategies and a team on your side…

You can retire comfortably and without stress.

👋 Hi, I'm Cameron Smith, founder of Bensons Wealth.

For 35 Years, We’ve Helped Over 3,000+ Australians Retire Comfortably

As financial planners, we help guide our clients to get set up for a retirement that they will love.

If you’re worried about having enough money for retirement…

Or you want to get a plan in place to retire comfortably…

And if you want to maximise your retirement savings, we can help.

Whether you plan to retire in 15 years, 10 years, 5 years, or even in the next 12 months…

I invite you to a free ‘Will I Have Enough’ Retirement Consultation.

This is where you’ll get to work directly with one of our planners and:

Discover the exact amount of money you need to retire comfortably

Uncover your ‘Freedom Day’—the day you can finally relax and enjoy your retirement

And discover strategies to maximise your savings for a relaxing retirement

Planning for retirement should be empowering, not intimidating.

Once you have a plan in place, you’ll feel the stress melt away and get crystal clear clarity on your retirement plan.

To get started, click the button below to discover if you’ll have enough and what you can do to maximise your savings for retirement.

To your success,

Cameron Smith

Founder of Bensons Wealth

3,000+ Australians Have Chosen Bensons Wealth To Guide Them To A Comfortable Retirement

Di

“We Wanted To Be Able To Live A Full Life”

Angel & John Faraguna

"When We Had The First Phone Call I Felt Quite Comfortable Speaking With Them”

Pam & Geoff Kohn

“I thought I'd have to work until I got my pension, but thanks to Bensons Wealth I can retire earlier if I want to. I feel really comfortable and confident about my future now.”

Debra

“They truly listened and provided practical advice. Working with him has been straightforward and trouble-free—exactly what we needed.”

Rob & Rose

"I Wanted A Worry Free Retirement... Which I've Got Now!”

Brian Davis

"They’ve made all the stress and worries go away, and I feel confident and secure, knowing my financial future is in good hands."

Leslie

"I no longer worry about my finances when I have a plan to sustain my lifestyle and I can seek their guidance whenever I need it."

Christine

Melbourne’s Premiere Retirement Planning Firm For Retirees Who Want More…

‘Knowledgeable, Open, Trustworthy’

Bensons Wealth has helped guide 3,000+ Aussies to retire comfortably and without compromise.

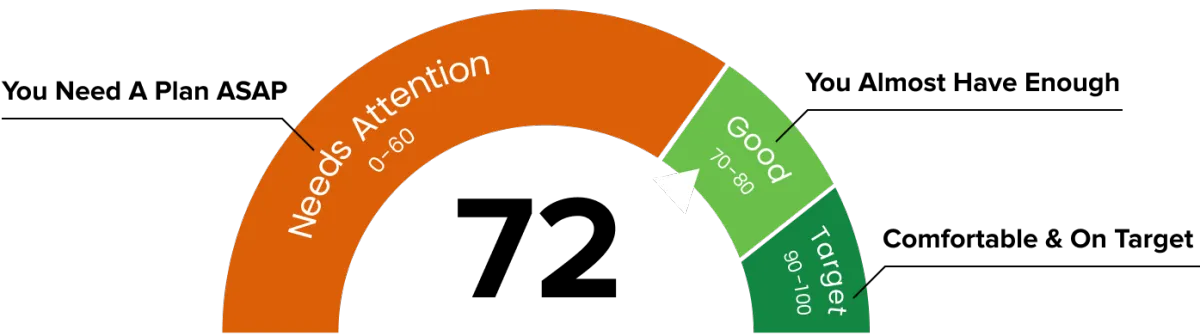

We use our proprietary ‘Will I Have Enough Index’ to uncover if you’ll really have enough for retirement.

As a small family business, we offer you personalised service tailored to your unique needs and goals.

Our team, led by Cameron, provides expert advice to help you develop a solid strategy you can trust and rely upon for a comfortable retirement.

Registered with ASIC and the Financial Adviser Register (FAR). We ensure the highest standard of professionalism and care for our clients.

Everyday, we’re on the frontlines, guiding our clients to protect their money, lower their taxes and navigate changes in the ever-changing markets.

After supporting 3,000+ Aussies across Australia, we’re here to support you and guide you through all aspects of your retirement.

And it all starts with getting a plan in place.

To get started, take the free ‘Will I Have Enough’ Retirement Consultation by clicking the button below.

INTRODUCING:

The Proprietary ‘Will I Have Enough?’ Index The Ultimate Retirement Planning Tool

The Will I Have Enough Index has been designed to give you instant clarity and direction when it comes to planning out your retirement.

After helping 3,000+ retirees plan their financial future, we’ve created our ‘Will I Have Enough Index’ to give you instant clarity on your retirement and future.

After the last few years of uncertainty, rising interest rates and rampant inflation… knowing if you have enough has never been more important.

The ‘Will I Have Enough’ Index is here to help guide you and give you clarity on how to approach your retirement.

Here’s what you’ll discover when you take the ‘Will I Have Enough’ Retirement Consultation:

Your Comfort Number: what number do you need to have in retirement savings to ensure you don’t run out of money in retirement while enjoying your lifestyle

Your Freedom Day: what day you can look at retiring and what you need to have in place to successfully transition into retirement

Your Management Plan: how Bensons Wealth can help support you as you come into their retirement years to ensure you can hit your lifestyle goals without having to compromise

We Partner With The Very Best

And Many More....

What You Need to Know Before We Meet

We work best with individuals/couples preparing to retire in the next 1–10 years

If you have $500k+ in super, our strategies can help you retire sooner

This isn’t a generic calculator — it’s a personalised consultation with a licensed financial adviser

HOW IT WORKS:

Get Confident With Your Retirement Plan In 3 Simple Steps:

STEP-1

Apply for Your Free “Will I Have Enough?” Consultation

Fill out our simple form and tell us more about your situation.

STEP-2

Speak With Our Team & About Your Retirement Goals

Talk with our advisors about your lifestyle and retirement goals.

STEP-3

Receive Your ‘Will I Have Enough’ Index Score

Get crystal clear clarity on where you stand and what you can do to get setup for retirement.

6 Reasons Why Our Clients Trust Us To Protect And Plan Out Their Retirement

Tailored to Your Ideal Lifestyle:

We craft retirement plans that revolve around your unique dreams and ideal lifestyle. We craft our plans around your goals, allowing you to enjoy your golden years to the fullest.

Unmatched Professionalism and Trustworthiness:

With over 35 years in the industry, your financial security and aspirations are our top priority. Our 3,000+ clients have chosen us and stay with us because of our impeccable track record.

Crystal Clear Communication:

Expect clear, prompt, and jargon-free updates that keep you fully informed. Our clients appreciate our straightforward and caring approach, ensuring there are no surprises with pro-active updates.

A Plan To Protect & Preserve Your Capital:

Our comprehensive strategies are designed to not only grow your retirement nest egg but also protect your capital from market volatility and inflation.

Expert Financial Knowledge:

Our seasoned advisors break down complex financial concepts into easy-to-understand language. This clarity empowers you to make informed decisions with confidence, knowing you’re guided by the best in the field.

No Lock-In Contracts:

Enjoy the flexibility of no lock-in contracts, knowing we are dedicated to providing you with tier 1 support and guidance at all times. We’re always working with our clients guiding them at every step of the retirement journey.

Helping Soon To Be Retirees To Get Setup For A Comfortable Retirement

"I’ve been dealing with Cameron for about ten years now and find him extremely helpful with all my financial planning for the present and well into the future. I am very pleased with his attention and professionalism!"

Chris Roberts

"I met with Eden at Bensons Wealth who looks after our Superannuation account. He is always very helpful and gives us good advice and some future projections depending on our strategy. I would have no hesitation in recommending Bensons Wealth to other family members and friends."

Gerard Luscombe

"My wife & I met with Chris for the first time this week. We had been seeing another advisor for some years so we were not sure what to expect and went to the meeting with some trepidation. We should not have worried, Chris was excellent..."

Ian Glascott

"My wife and I have had Chris looking after our financial matters for a few years. It is so important to have sound advice especially when approaching retirement."

Peter T

"I have been a client of Bensons Wealth for over 15 years. Throughout this time, they have consistently provided exceptional service and sound financial advice. I trust them completely with my investments and retirement planning."

John Smith

"Happy with their service, get great advice, options, they explain anything I don't understand and yes I would recommend this company, so far I do feel well looked after."

Monica Martinez

"As we headed towards retirement and having no plan, we approached Bensons for financial advice. Cameron and his team made us so feel so comfortable as we discussed our future goals..."

Angela Faraguna

"Chris has been great to liaise with. He listens and communicates very effectively. I feel confident with the management and ongoing support with which my circumstances and needs are handled. Highly recommended."

Leisel

"We always have a clear understanding of how our financial situation is. Chris is very professional and goes over and above to help me understand everything. We couldn’t be happier."

Wendy Davies

Bensons Wealth Can Help You With All Your Retirement Planning Needs:

Comprehensive financial planning

Debt management

Estate planning

Investment management

Tax optimisation

Ongoing financial monitoring and adjustments

Retirement planning and income strategies

Superannuation advice

Concierge service for administrative needs

WARNING!

Delaying Your Retirement Plan Could Hold You Back From A Comfortable Retirement

Every day past the age of 50 counts when it comes to planning your retirement.

The decisions you make today can set you up for a relaxing retirement or could keep you working well into your golden years.

The smartest action you can take today is getting clear on what you want and getting a plan in place to get you there.

At Bensons Wealth, we’re here to support you on your journey to retirement…

But we also know, the best retirements are designed with a plan in place.

And the best way to get started is with our free ‘Will I Have Enough?’ Retirement Consultation.

It’ll take you from uncertainty to crystal clear clarity when it comes to approaching your retirement.

Click the button below to book in your consultation now.

Please don’t wait until it’s too late.

Apply For Your Free ‘Will I Have Enough?’ Retirement Consultation

Finally, Know How Much You Need To Retire Comfortably, When You Can Retire, And How To Get There Faster

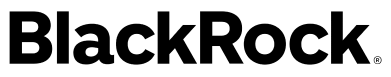

Discover your ‘comfort number’

We’ll help you figure out exactly how much money you need each year to enjoy the retirement lifestyle you want.

Find your official ‘freedom date’ and retirement timeline

By looking at your current finances and the lifestyle you want to live, we can tell you the exact date you can retire and feel secure that your money will sustain your golden years.

Maximise your finances and accelerate your retirement

We’ll help you make the most of your superannuation, determine the best tax strategies, and grow your money so you can retire sooner than you think.

Frequently Asked Questions

What is the ‘Will I Have Enough?’ Retirement Consultation?

Our consultation helps determine your ‘comfort number’ and ‘freedom date’ for a comfortable retirement. Is the consultation really free? Yes, it’s completely free with no obligation to move forward.

How long does the consultation take?

This depends on when you book in your free consultation call - typically you’ll receive it within a week.

What if I don’t have a lot of savings?

Our analysis helps you make the most of what you have. We typically help clients with a savings/super amounts of $300K to $3M.

Can I trust Bensons Wealth?

With 35+ years, 3,000+ clients, and a stellar reputation, we guide you to a comfortable retirement.

The most important thing is that you feel comfortable and safe. This is why we have our ‘Will I Have Enough’ Retirement Analysis. It’s a way for you to see if we are a good fit, and that we can truly help you with your financial goals.

What are your fees?

Fees vary based on your needs and level of service required.

We don't take commissions or kickbacks—our focus is solely on working for you.

Plus, we offer an industry leading, no long-term contracts; ensuring that we always provide you with Tier 1 service.

Why Do I Need A Financial Planner?

Think of us as mechanics for your money. We help tune up your money and portfolio of investments. We look to grow and protect your money, ensuring your retirement dreams become reality and guide you through your financial decisions.

How does it work if we work together?

As an independent family business, we tailor your plans to fit your needs, not push products.

We partner with you so you can make informed decisions about your money throughout the year. We guide you to make smart decisions and help you to protect your wealth and grow your investments.

You’re in complete control, and we’re here to guide you to make the best decisions when it comes to your financial future.

How much do I need to retire?

It depends on your lifestyle goals and retirement location. We'll crunch numbers to see if your savings support your plans.

If adjustments are needed, we'll work on strategies to get you there comfortably and securely.

Do you only invest my money?

We look at your entire financial picture—debts, income, taxes, retirement goals, investments, insurance, super and tax.

Our goal is to grow your wealth, save on taxes, and protect from financial risks for a safe retirement journey.

Claim Your Free ‘Will I Have Enough’ Retirement Consultation Today